Home

About Us

Latest Posts

An Australian Perspective on Social Impact Investing

January 31, 2022 10:19 pmA new book co-authored by InDaily 40 Under 40 alumna Carmen Garcia examines the components required to strengthen Australia’s social business investment sector.

This relatively new notion was initially introduced in 2007 during a Rockefeller Foundation meeting hosted in Italy’s Bellagio Center.

Governments are increasingly recognizing their role in expanding the SII market, not just as market facilitators and regulators, but also as active market participants or purchasers of social effects.

In the end, the Australian Taskforce on Social Impact Investing report (2019, p. 22) “envisions a future where Australia has a deep capital market for social impact investments facilitated by skilled specialist advisor ‘intermediaries’, with measurable social and financial returns across a broad range of investments – from low to market-rate financial return”.

To become a deep market with many players and on a broad scale, the Australian SII market need competent intermediaries that can enable and organize SII investments (such as Social Impact Bond arrangements). Intermediaries in the SII sector include Social Ventures Australia and Social Finance UK.

Social impact investment requires a framework for assessing the overall viability, performance, and service delivery capabilities of social service providers.

BlueMark Raises $3.75 Million To Drive Greater Adoption Of Impact Verification

January 29, 2022 9:21 amBlueMark, a provider of impact verification services for investors and businesses, has announced a total funding of $3.75 million from the Ford Foundation, Radicle Impact, The Rockefeller Foundation, and the Tipping Point Fund on Impact Investing.

BlueMark will use the funds to expand its verification services across industries and geographies. The firm’s comprehensive approach to verification encourages impact investors to raise the bar on their impact performance.

Impact Investment Conference at the Vatican

July 10, 2018 7:09 pmAn article in Crux, a publication “Taking the Catholic Pulse,” provides perspective on the Vatican’s third convening on impact investing and the critical role the church can play in facilitating growth in this area.

This is the third time the Vatican has convened investors, fund managers, and commercial bankers with various heads of Catholic charities and aid-related missions to explore the Church’s involvement in impact investment. It’s sponsored by Turkson’s department, Catholic Relief Services (the overseas development arm of the U.S. bishops) and Caritas Internationalis (the Rome-based federation of Catholic charities around the world).

During several panels and working sessions, the conference will try to provide a platform for a long-lasting conversation not only between the investing side and the enterprise side, but also the public sector, a third key element in fighting inequality that results from an excessive concentration of wealth.

When consulted by Crux, some of the participants argued that the aid and relief organizations the Catholic Church runs are already “ideal vehicles” for impact investment because their focus on livelihood improvement, financial inclusion, environmental protection and public health neatly aligns with the mission of many impact funds.

How impact investing is changing philanthropy – Technical.ly Baltimore

July 6, 2018 1:35 amImpact investing can lead to new strategies for entrepreneurs and mission-driven businesses. That means room for new people to receive investment.

“It cannot just be about the elites. It really has to include everyone,” said Case Foundation President Jean Case, echoing a core belief that’s reflected both in the foundation’s work and the message of her husband, AOL cofounder Steve Case. She made the remarks during a panel of foundation presidents at the Mission Investors Exchange conference [in May 2016] in Baltimore.

Source: How impact investing is changing philanthropy – Technical.ly Baltimore

All About Corporate Social Responsibility

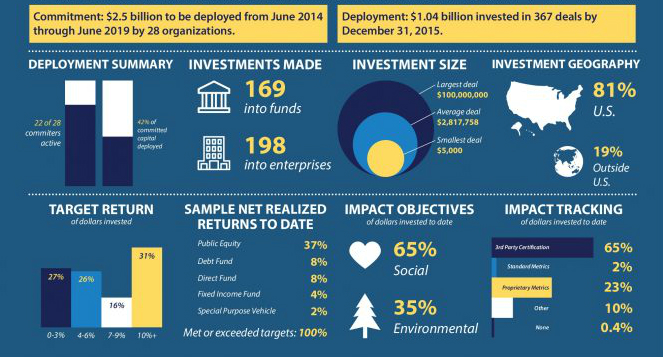

April 10, 2017 5:33 am$1.5 Billion Committed to Impact Investing, Where’s the Money Now?

September 15, 2016 6:09 pmIn 2014, [The Center for the Advancement of Social Entrepreneurship (CASE)] had been invited to be part of the United States National Advisory Board on Impact Investing (the NAB). An impressive group of impact investing professionals from industry, philanthropy, government and academia, we had been meeting for nearly a year under the auspices of the Social Impact Investment Taskforce established by the G8. Our purpose: to collect advice and make concrete recommendations for how US policymakers could encourage more impact investing.

To make the effort more concrete the NAB solicited commitments from participants in the investment communities to inject new funds into the impact investment space. By June of 2014, 29 organizations had promised to invest $1.5 billion in new funds.

An assessment 18 months later showed that more than $2.5 billion had been invested by the group of funders.

Private Banks Massively Increase Impact Fund Offerings

June 25, 2016 1:43 amAccording to the Global Sustainable Investment Alliance, the global market for impact investing—which it defines narrowly as targeted investments aimed at solving social or environmental problems—has surpassed $109 billion, 26% higher than in 2012. That number is expected to increase to $650 billion by 2020, claims the Calvert Foundation.

The impact investing business, not too long ago a cottage industry with only tiny funds on offer, is increasingly coming to market with more and bulkier impact investing funds, which is changing the industry’s dynamics.Consider the Pax Global Environmental Markets Fund, which has $305 million assets under management in the U.S. and $4.6 billion globally. Its global equity strategy is focused on companies that are efficient with water, waste, and energy, and firms active in sustainable food and agriculture.

There’s a low $1,000 minimum investment at the fund and a 1% management fee; it’s distributed by banks and broker dealers. The fund has earned an average 6.6% annually over the last three years.

Source: Private Banks Massively Increase Impact Fund Offerings – Penta Daily – Barrons.com

Impact Investing in Action

April 1, 2016 8:41 amImpact Investing – Fiction and Hard Facts

March 29, 2016 8:21 pmMeasuring the Impact of Impact Investing

February 3, 2016 11:58 pm Leave your thoughtsAn organization called New Philanthropy Capital designed a program that helps investors see the progress of their investments. The program is known as Impact Assurance Classification. It creates reports based on the impact an investor has based on investment, theme, and contribution. This program makes it possible for impact investors to not have to analyze this type of data on their own and for more thorough reports to be created.

The article discusses the experience that a foundation, K.L. Felicitar, has had with this program. Through these reports, the investors, Lisa and Charly Kleissner, have been able to see the effects of their foundation. This includes findings such as the benefits of working through London-based NPC (National Planning Corporation) versus through the United States. They have also been able to see where their investments have gone and how these contributions have benefited different societies.

Read the full article here:

Impact investing pioneers release report to measure impact of portfolio

Social Entrepreneurship

Spotlight

Building a Million Dollar Company Where Everyone Counts

Ganesh Natarajan is the Founder and Chairman of 5FWorld, a new platform for funding and developing start-ups, social enterprises and the skills eco-system in India. In the past two decades, he has built two of India’s high-growth software services companies – Aptech and Zensar – almost from scratch to global success.